People face a whole range of different personal finance challenges and often ask us for tips. The area of savings and investments is the one we’re asked about the most. So we thought it might be useful to give you a few tips to consider to best manage your hard-earned cash. Of course we strongly advise you talk to an expert about these first, to help you identify which of these are right for you.

Pay yourself first & save up to 10% of your monthly income

One of the biggest mistakes that people make in relation to saving is that they place it as the lowest priority item in their monthly budget. They pay their mortgage, their bills, they go shopping, they spend on luxury items and entertainment, they probably waste a few bob…and then they save whatever is left over! So effectively you’re paying yourself last.

One great habit of saving is to pay yourself first every month, immediately after you are paid. If you’re running out of money then at the end of the month, yes, you’ll have to “dip in”. But you’re much less likely to waste money, if you have to dip into your savings to do so. And how much should you be saving? Aim for 10% of your income, even more if you have no pension scheme in place.

Be careful of individual shares

So you get a great share tip. What do you do? Throw a lot of your money at it to really make a worthwhile gain? Well, be really careful, this is a very risky strategy. We only have to consider all the unfortunate people in Ireland who only 6 years ago had their wealth tied up in the shares of an Irish bank. Because they were a “sure thing”, with no risk attached. These people lost the lot.

Always spread your risk and build your wealth through funds or pools of shares. This diversification will give you some protection against one of the companies you’re invested in going south.

Learn the ” Rule of 72″

The Investopedia definition of the Rule of 72 is that it is a simplified way to determine how long an investment will take to double, given a fixed annual rate of interest. By dividing 72 by the annual rate of return, investors can get a rough estimate of how many years it will take for the initial investment to duplicate itself.

For example, the rule of 72 states that €1 invested at 10% would take 7.2 years ((72/10) = 7.2) to turn into €2.

Knowing this rule will help manage your expectations in relation to the performance of your portfolio or will help you identify the return needed to double your money in a specific timeframe.

Follow an Asset Allocation Strategy

Spending time getting your asset allocation right, and adjusting it as your investment objectives and/or market conditions change, is a much more robust investment strategy than trying to pick the right stocks. Yes picking the right stocks can result in very sharp gains in a portfolio. However they also can result in very steep drops too. Spending the time getting your asset allocation right and then adjusting it as required is likely to result in a more consistent return. Of course this is where we can really help you! We can help you identify the right allocation to suit your investment objectives and risk profile, and then help you to implement it.

Use investment strategies to increase wealth

There are a number of different strategies that you can use that are likely to serve you better than an ad hoc approach. A few to consider include:

- Buy and hold: This is where you buy investments (usually stocks) and keep them for a long time, ignoring short-term fluctuations in the market.

- Pound cost averaging: This is where you invest a fixed amount of money in a fund or basket of shares on a regular, monthly basis. When prices are high, your monthly amount will purchase less shares of a well-performing asset, but if the price falls, your “new” money will buy more shares.

- Rebalancing: This is where you identify your desired asset allocation at the outset and then buy or sell assets in your portfolio to maintain this allocation as the prices of the assets change.

Adopt a non-emotional investment approach

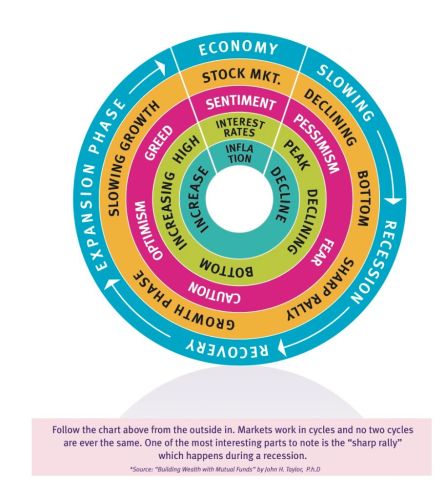

Look at investment markets coldly and don’t allow emotion to cloud your judgement. Greed and fear are two of the greatest threats to a good investment strategy.

Learn the Market Cycle

The investment market usually (but not always) follows a typical cycle as shown below. While you obviously cannot rely on all of the different factors coming together as illustrated, this is a useful picture to bear in mind.

Get independent advice

Well we would say that, wouldn’t we? But this is so important. Your independent financial adviser can help you navigate your way through the choppy investment waters, with their sole objective being to help you achieve your investment goals. We’d be delighted to talk you through any of the tips in this article.